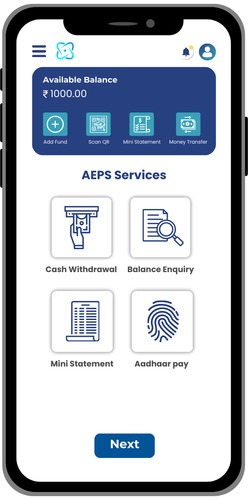

AEPS or aadhar enabled bill payments system that allows you to pay through an aadhar card. AePS is a payment model that is conceptualised by the NCPI that allows the customers to do basic payment transactions like cash deposits, bank to bank transfer balance inquiries, mini statements, aadhar to aadhar funds transfer authentication, BHIM aadhar pay, and many more using their aadhar card.

BY using AePS, merchants can also offer additional services like eKYC, best finger detection, demo auth, tokenization, Aadhar seeding status to their customers and users.

AePS is an interoperable bank transaction system that allows users to send and receive money from any bank to any bank. This means that all the users need in order to do a business transaction form and bank to any bank is:

- Name of the bank

- Aadhar card number

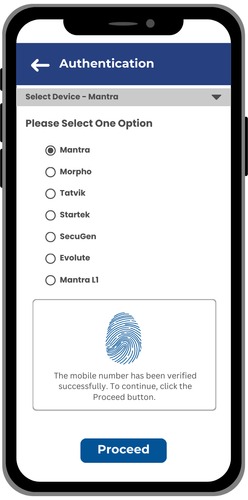

- Fingerprints

Why provide AePS to your customers: Increase in customers, Increase in business

AePS allows users to do business transactions using only their aadhar. This is so convenient for them as they don't need any other documents other than their aadhar cards and the name of their bank. As a result, more people are using it. Thus by offering AePS transaction services you can attract more customers to your business, and earn the highest commission on each completed transaction through Creative india.

Why provide AePS services through Creative india ?

Highest Commissions :Because with Creative india you are sure to earn the highest commission on each completed transaction thereby allowing you to increase your income generated from each online AePS transaction.

Seamless transactions/ More income :Creative india allows you to provide AePS services seamlessly to your customers thereby attracting more customers to your business which means more income for you.

Realtime settlements :With Creative india’s real-time settlements status, you can check whether the transaction succeeded or failed, which means no default payments and no wrongful money deductions.

Secure and reliable service : Creative india ensures that every transaction is completed reliably without delays or failure making Creative india a name that you can trust. Your data is safe with us. With our best-in-class data security, we make sure that your is secure so that you can focus on growing your business.

Operate using any bank : With Creative india, provide AePS services such as a bank to a bank transfer, cash withdrawal, and cash deposit to your customers using any bank. With the added security of the Creative india wallet, send and receive money from any bank and provide your customers a superior banking experience while earning the highest commission in the industry on each successful AePS transaction.

1.What basic transactions can a retailer perform with AePS?

Retailers can perform a variety of basic banking transactions using AePS. With this service, retailers can assist customers in withdrawing cash, and check balance, and provide customers with a mini-statement detailing their recent account transactions. This convenience makes it easier for customers to access their funds and stay informed about their financial activities.

2. How can a retailer transfer money from their Creative India balance to a bank account?

Retailers can transfer money from their Creative India balance to their bank account by utilizing the payout facility. This process allows them to easily move funds from their Creative India account into their linked bank account.

3. How much money can be withdrawn in one transaction?

The withdrawal limit depends on the customer's bank account and the balance available at the retailer, with a maximum limit of 10,000 as per POS.

4. What are the inputs required for the retailer to do a transaction?

Retailers require three essential things to complete a transaction: their Aadhaar-linked bank account, Aadhaar number, and biometric validation. These elements are necessary to ensure secure and accurate transactions when using AePS.

5. How will customers know when their transaction is complete?

Customers will be notified of the completion of their transaction through two channels. Firstly, they will receive an SMS from the bank, providing confirmation and details of the transaction. Secondly, retailers conducting the transaction will see the corresponding funds added to their trade balance, ensuring transparency and confirmation of the completed transaction.