Discover the possibilities today with our m-ATM!

The future of convenient, on-the-go banking. m-ATM is your all-in-one solution, empowering retailers to assist their customers with ease. This revolutionary device functions just like a traditional ATM, offering the flexibility to withdraw cash, check account balances, and conduct basic banking transactions at any time and from anywhere. Earn commissions while providing this essential service.

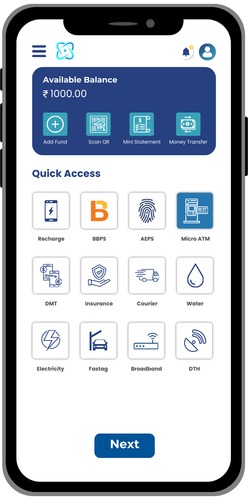

Discover the convenience of banking in the palm of your hand with Creative India’s MATM service. Our Micro ATM platform revolutionizes the way you perform financial transactions, making banking services accessible even in the most remote locations. MATM is more than just an ATM; it’s a compact, user-friendly device that brings essential banking services to your doorstep. From cash withdrawals and deposits to balance inquiries and fund transfers, our MATM service simplifies banking, making it quick, easy, and secure. With the integration of biometric verification, we ensure that each transaction is safe and personalized, offering peace of mind and reliability in every interaction.

At Creative India, we are committed to bridging the gap between urban and rural banking with our MATM service. We understand the challenges of accessing banking facilities in remote areas, and our MATM solution is designed to overcome these barriers. This service empowers local communities, providing them with the tools to manage their finances effectively and independently. By using our MATM devices, users can enjoy the benefits of digital banking without the need for complex infrastructure or travel to distant bank branches. Our aim is to foster financial inclusion, ensuring that everyone, regardless of their location, has access to essential banking services. Embrace the future of banking with Creative India’s MATM, where convenience meets security.

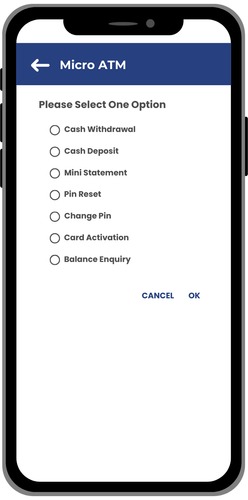

To launch this portal, you need to complete the verification process like fingerprint scan or Aadhaar card with card swipe option. Once your identity is verified, you can choose from various transaction options such as cash deposits, direct debits, eKYC-based savings accounts, Aadhaar seeds, cash withdrawals, balance enquiries, and accepting service requests. To complete the transaction, just select the desired option, a message will appear on the screen and the receipt will be printed. After completing the transaction, as usual, you will receive a confirmation of the transaction via SMS from your bank.

How to get started with your mATM Service ?

If you are looking for the best Micro ATM, Swift Micro ATM is the right choice. Swift Micro ATM is a compact, wireless device that enables easy POS transactions and Cash Withdrawals.There are two types of Swift mATM devices - the Swift mATM machine, a pocket sized device best for usage through mobile phone, and a Standalone POS terminal, for operation through a fixed location using credit and debit cards.

Step 1:Insert your debit card or enter your registered mobile number. The first step to using a Micro ATM is to insert your debit card into the device or enter your registered mobile number linked to your bank account.

Step 2: Select the type of transaction. Once your card or mobile number is verified, the Micro ATM will display a list of available transactions. Select the type of transaction you want to perform, such as cash withdrawal, balance inquiry, or fund transfer.

Step 3: Enter the transaction amount Enter the amount you want to withdraw or transfer, or select a predefined amount from the options available on the screen.

Step 4:Verify the transaction Verify the transaction details, including the amount and the account number, before proceeding.

Step 5: Enter your PIN Enter your four-digit PIN to authenticate the transaction.

Step 6: Collect your cash or transaction receipt Once the transaction is approved, the Micro ATM will dispense the requested amount of cash or provide a transaction receipt with details of the transaction.

You will get the following features in your mATM:

You will get the following features in your mATM:

1.What is a Micro ATM ?

A Micro ATM, also known as a mini ATM or a point of sale (POS) terminal, is a handheld device that allows individuals to perform basic financial transactions, such as withdrawing cash or checking their account balance, using a debit card or a mobile number linked to their bank account.

2. What transaction can be performed using a mATM?

Micro ATMs are designed to provide basic financial services such as cash withdrawals, balance inquiries, fund transfers, and bill payments.

3. Who can use a Micro ATM ?

Anyone who has a debit card or a mobile number linked to their bank account can use a Micro ATM.